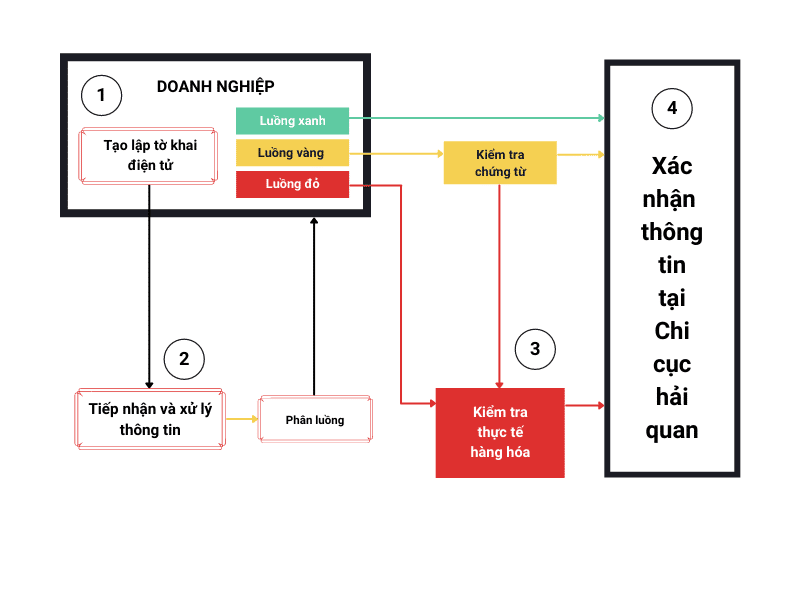

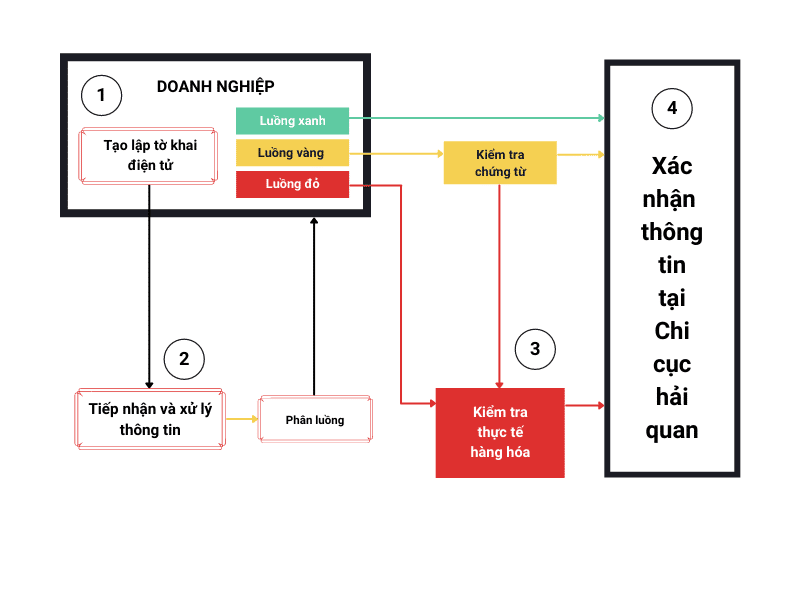

When doing customs procedures, the declarant (goods owner, customs agent, or customs declarant) performs the following basic steps:

1. Declare and submit customs declarations

The customs declaration is made according to the prescribed form. About ten years ago, goods owners declared by handwriting on pre-printed paper declarations. Up to now, all Sub-Departments have switched to declaring and submitting declarations in the form of electronic customs by specialized software.

Since April 2014, the customs authority has started to apply the new VNACCS system, and the declaration form has also changed a lot.

In this step, it is necessary to check to ensure accurate data between documents, look up and apply HS Code, transfer declarations...

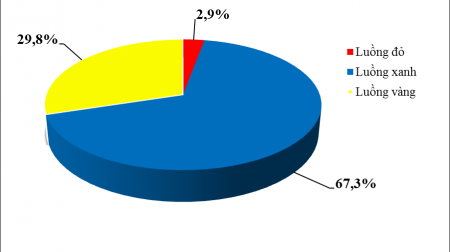

2. Get threading results

In theory, you just need to go to the port to pick up the goods after paying the tax (if any), without having to do anything else.

However, in fact, at the branches in Hai Phong, I see that the declarant still has to go to the customs to check whether the tax has been floating in the customs treasury account or not. At the same time, the customs officer also checked to see if the declaration had any problems or not. If a (serious) error is found in the declaration, the customs can still stop the procedure and request the leader to change the channel (if necessary).

Indeed, that is not the true meaning of the green stream. Therefore, you should still prepare a set of goods documents, to explain when needed. Then make sure to eat!

Golden stream declaration

You must present a paper application package, including documents such as:

Customs declaration (printed from software, no stamp required)

Commercial Invoice (Signature, round seal + title)

Other documents: Bill of lading, C/O, quality inspection paper (specialized inspection)...

According to Circular 38, customs documents are simpler, no need for Foreign Trade Contract and Packaging Details, but you should prepare a copy ready to refer to and look up data when needed.

From August 2022, you only need to electronically transmit the document files through the customs declaration software, and only have to submit the original C/O (if any).

Red stream declaration

The actual goods must be inspected after completing the inspection of the paper documents. This is the highest level of inspection, having to do many procedures and consuming the most cost, time and effort for both goods owners and customs officers.

First of all, you still have to have a set of documents like the golden stream above. After the customs receives and approves the dossier, it will be transferred to the inspection team. You register for inspection, go to the port to carry out the procedures for unloading the goods to the inspection area, and then contact the customs officer to come down to do the inspection procedures.

Currently, there are two forms of inspection: inspection by scanners (checks), and manual checks (referred to as "brake checks"). In some cases, the customs inspection machine was suspicious and opened the container for manual inspection (very tiring and expensive!).

After the inspection is completed, the customs officer will return to the Sub-Department to carry out the necessary procedures: the inspection record. If ok, will do the procedure to decide & peel off the declaration to finish the part at the branch. You print the bar code of the customs declaration, and go to the port to complete the procedure for changing orders & signing for customs supervision (also known as signing the yard gate) and you're done.

One more useful detail, during the procedure, you can go to the website of the General Department of Customs to update the status of some work steps:

Look up tax payment, customs tax debt: after paying tax, look up if the status is "Out of debt", which means the tax has been deposited into the customs account. If not, you have to wait, and should check the tax payment, if necessary.

Look up the customs declaration: look up the status of the declaration: cleared or not, date and time of customs clearance...

Barcode printing of customs declaration: if there is a barcode, it is cleared.

3. Pay customs duties

The software will automatically calculate the amount of tax payable, based on the current import and export tariff.

Taxpayers pay tax and fulfill financial obligations according to regulations: immediate payment, grace period, bank guarantee, etc. For imported goods according to the current business model, most of them are subject to immediate tax payment. When there is a floating tax in the system, the new customs will approve the clearance for the shipment.

4. Customs clearance of goods

Cargo clearance is the completion of customs procedures for import and export goods.

After the above steps and the goods are accepted by the customs, you are done with the responsibility. At that time, with imported goods, the goods owner is entitled to distribute, buy, sell, use...; As for export goods, goods are eligible to be brought out of Vietnam (or brought into the Non-Tariff Zone).